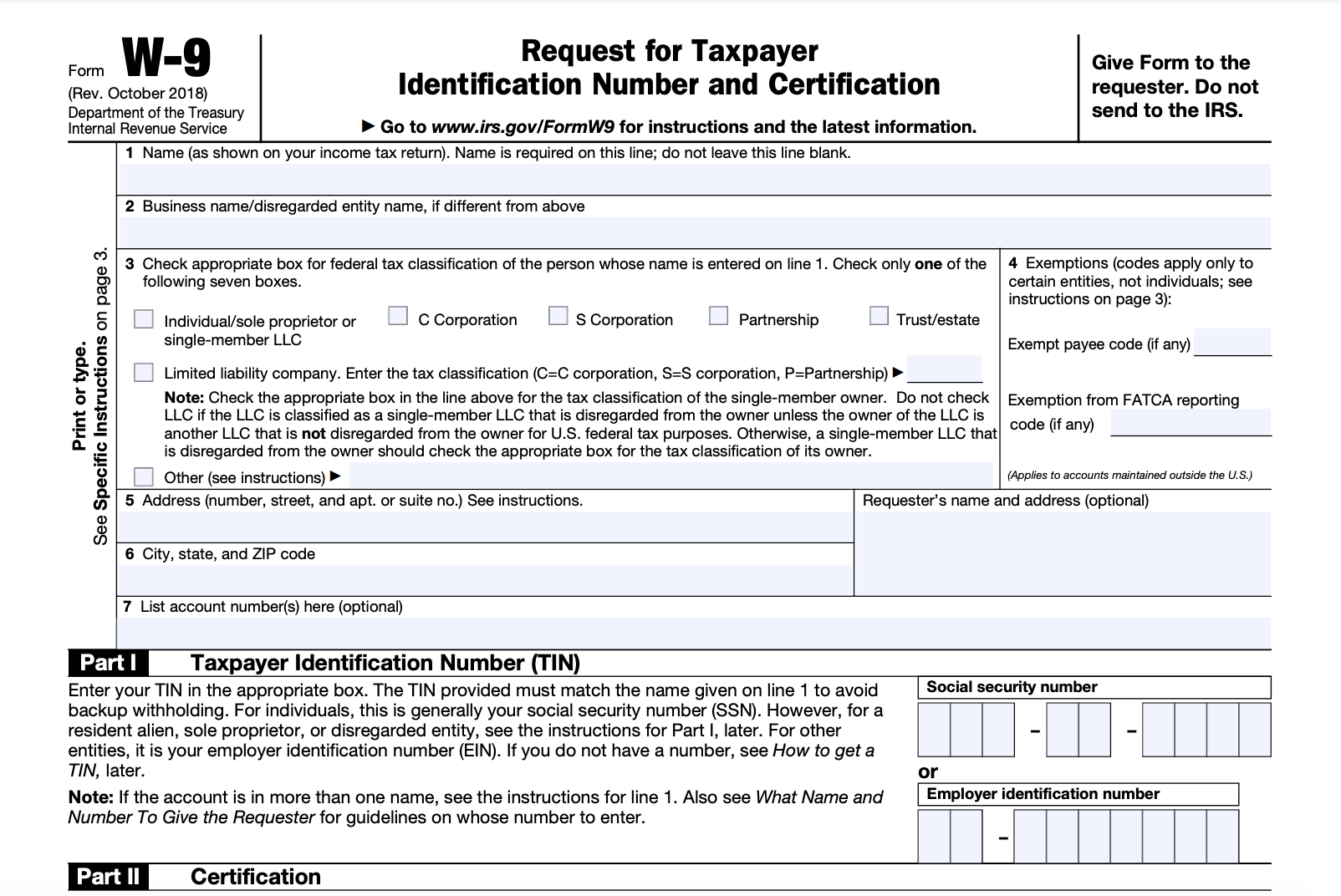

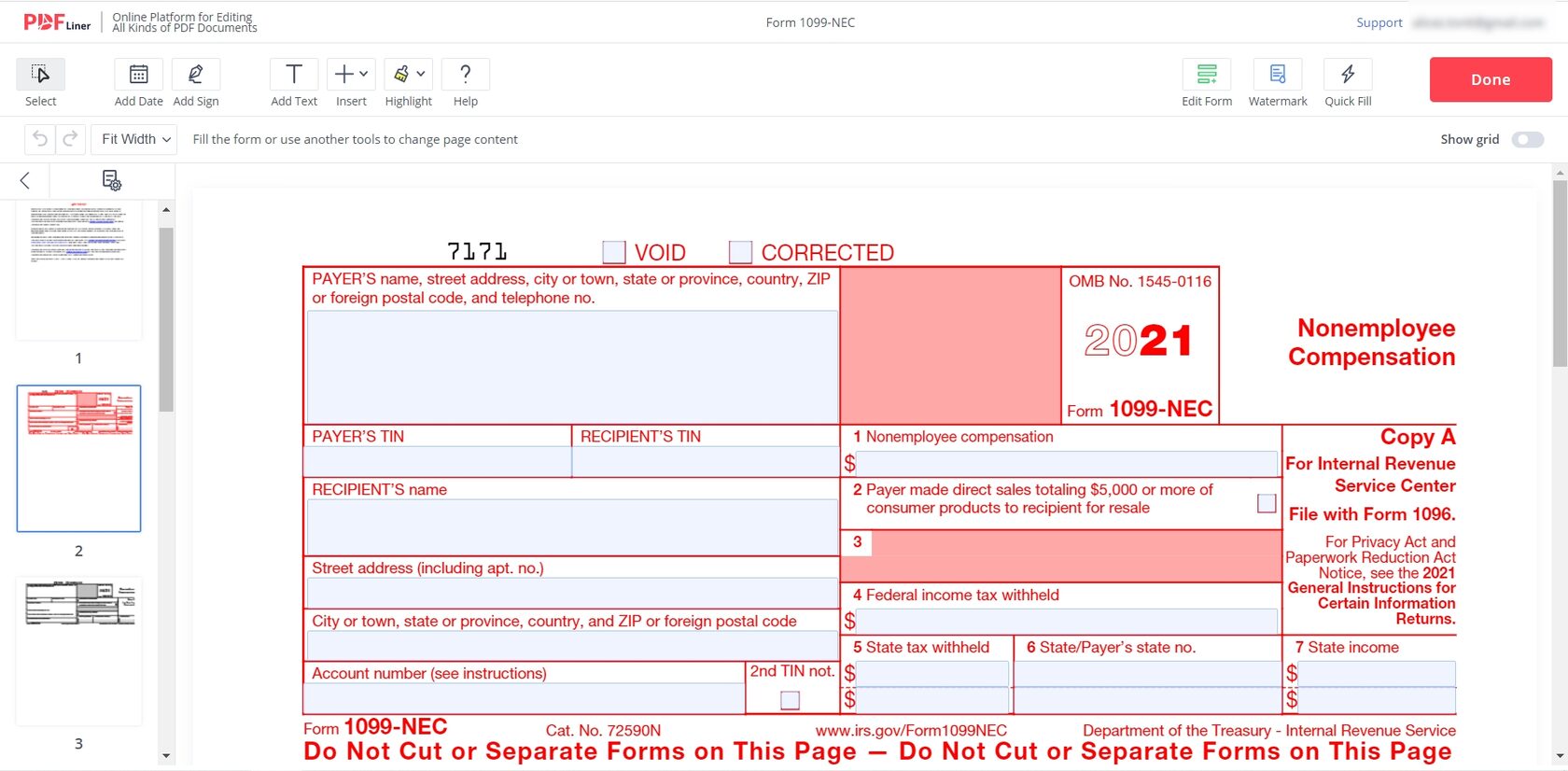

A 1099 form is a tax form used for independent contractors or freelancers Please list below all individuals who meet these qualifications For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and Start a free trial now to save yourself1099 form independent contractor 21 Fill out documents electronically utilizing PDF or Word format Make them reusable by creating templates, include and fill out fillable fields Approve forms with a lawful electronic signature and share them via email, fax or print them out download forms on your PC or mobile device1099 contractor agreement agreement made as of _____, between eastmark consulting, inc, a 1099 independent contractor form pdf In the year 21 1099 form is used to avoid

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

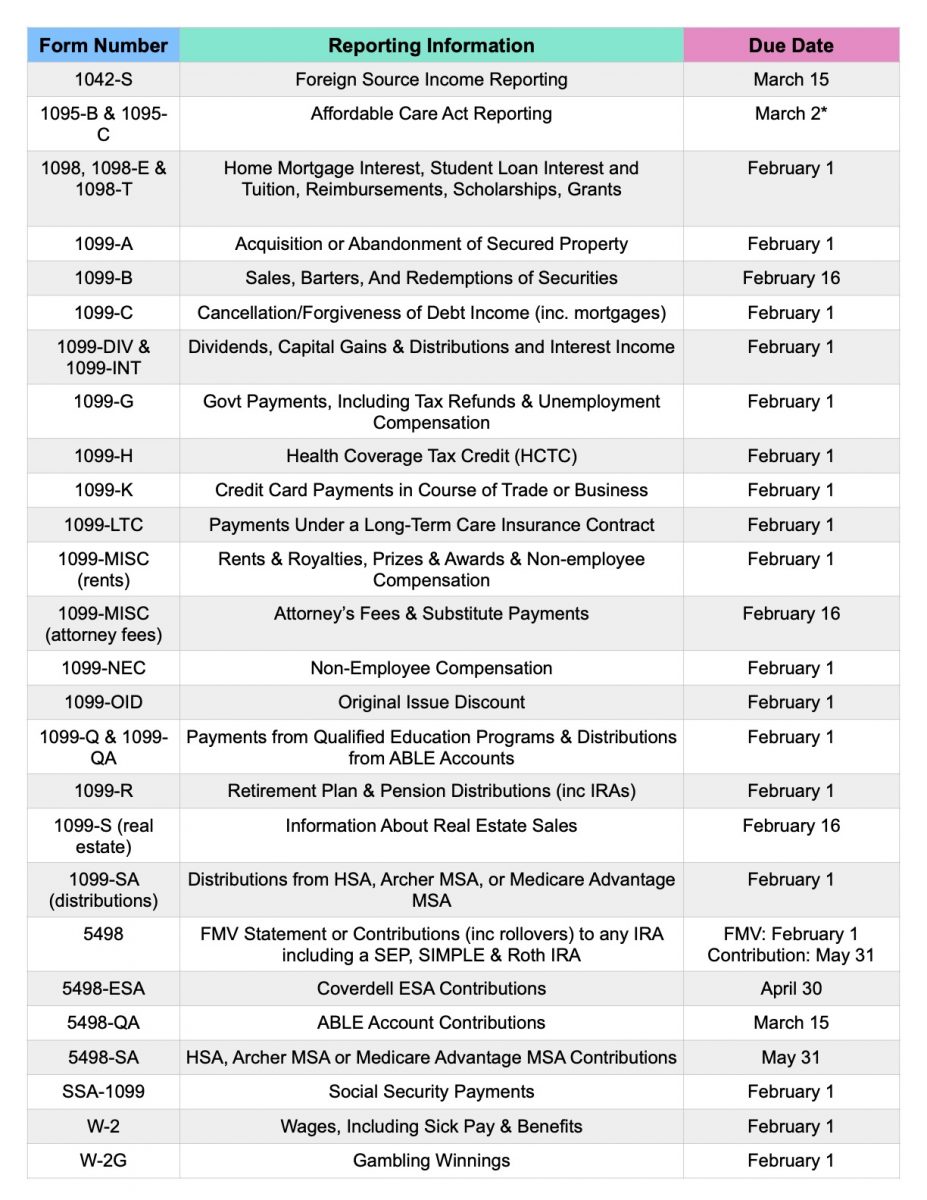

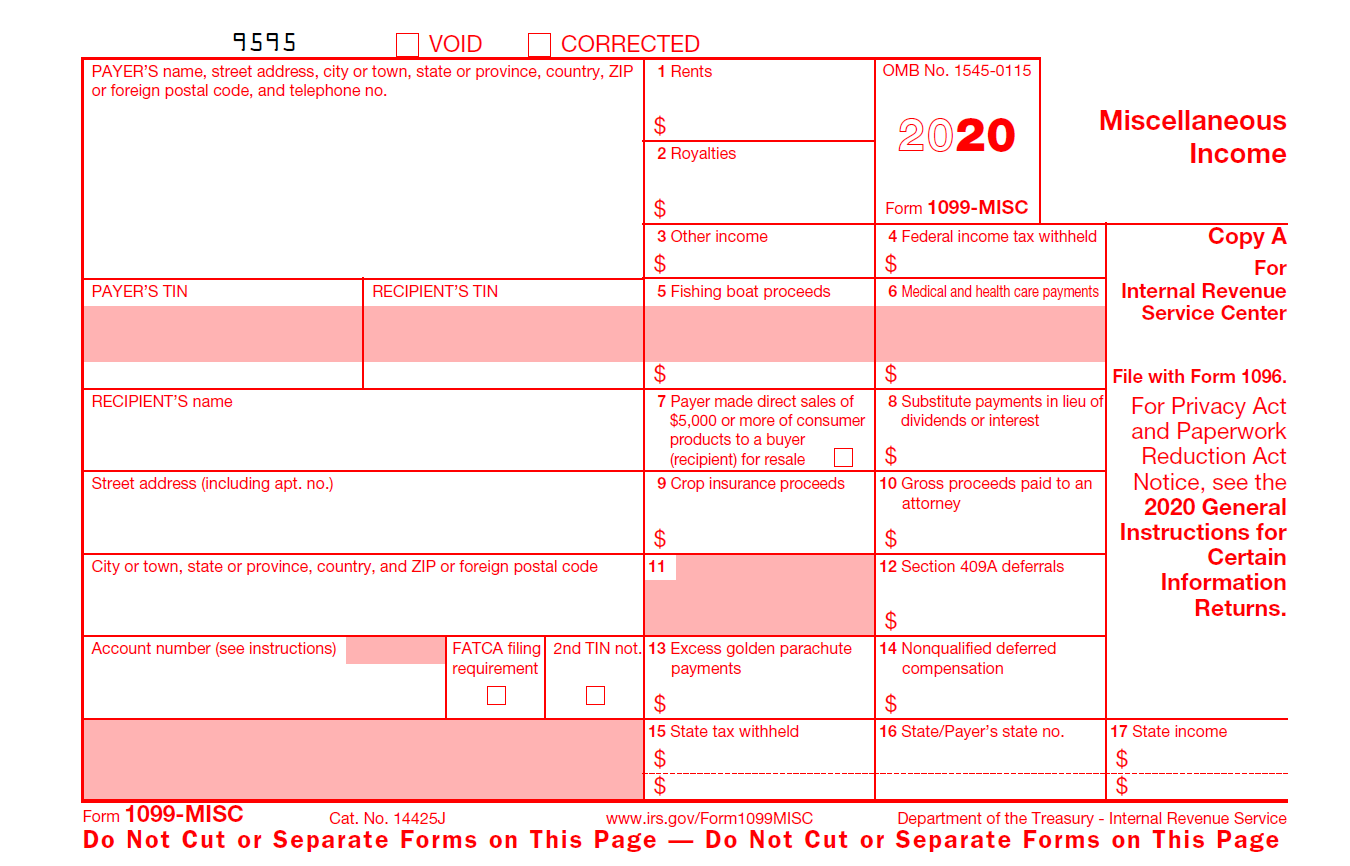

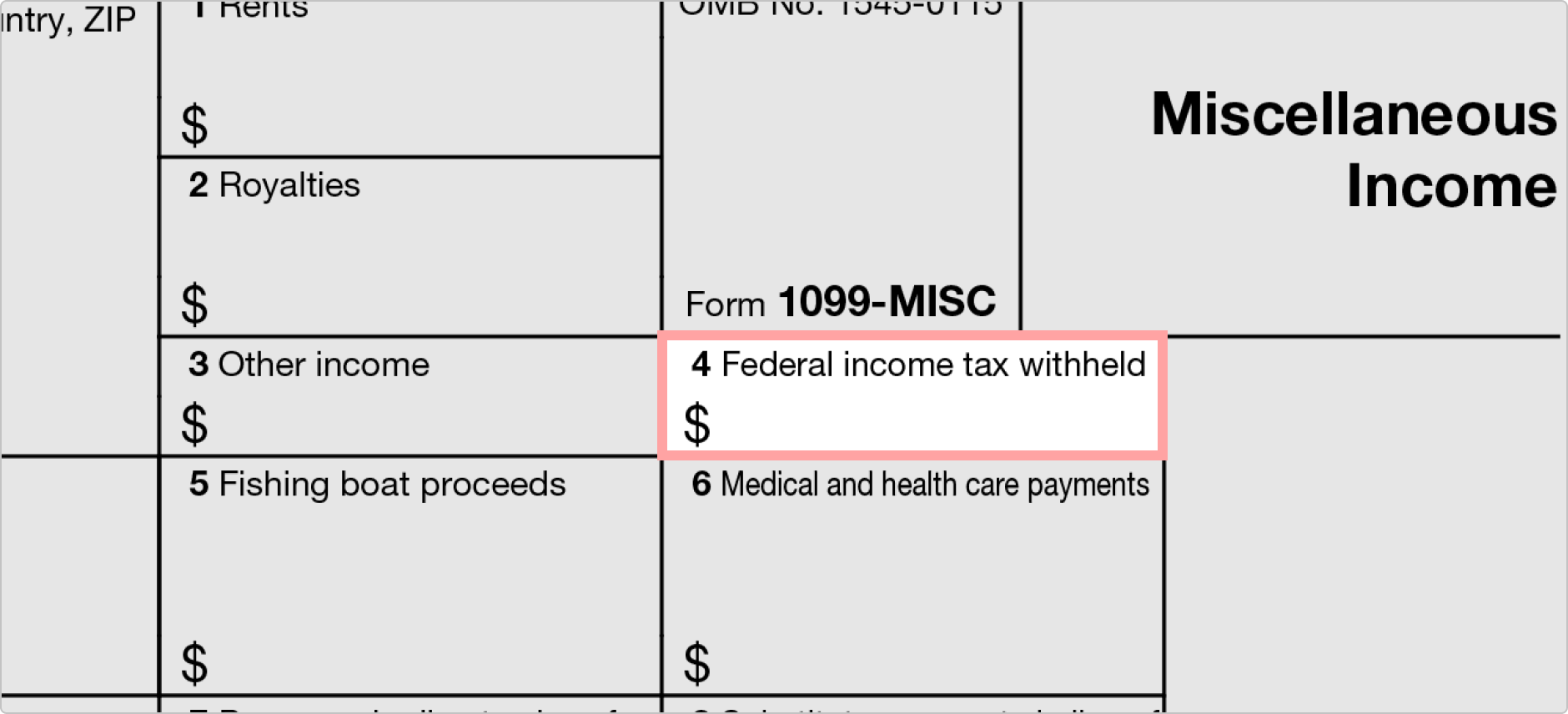

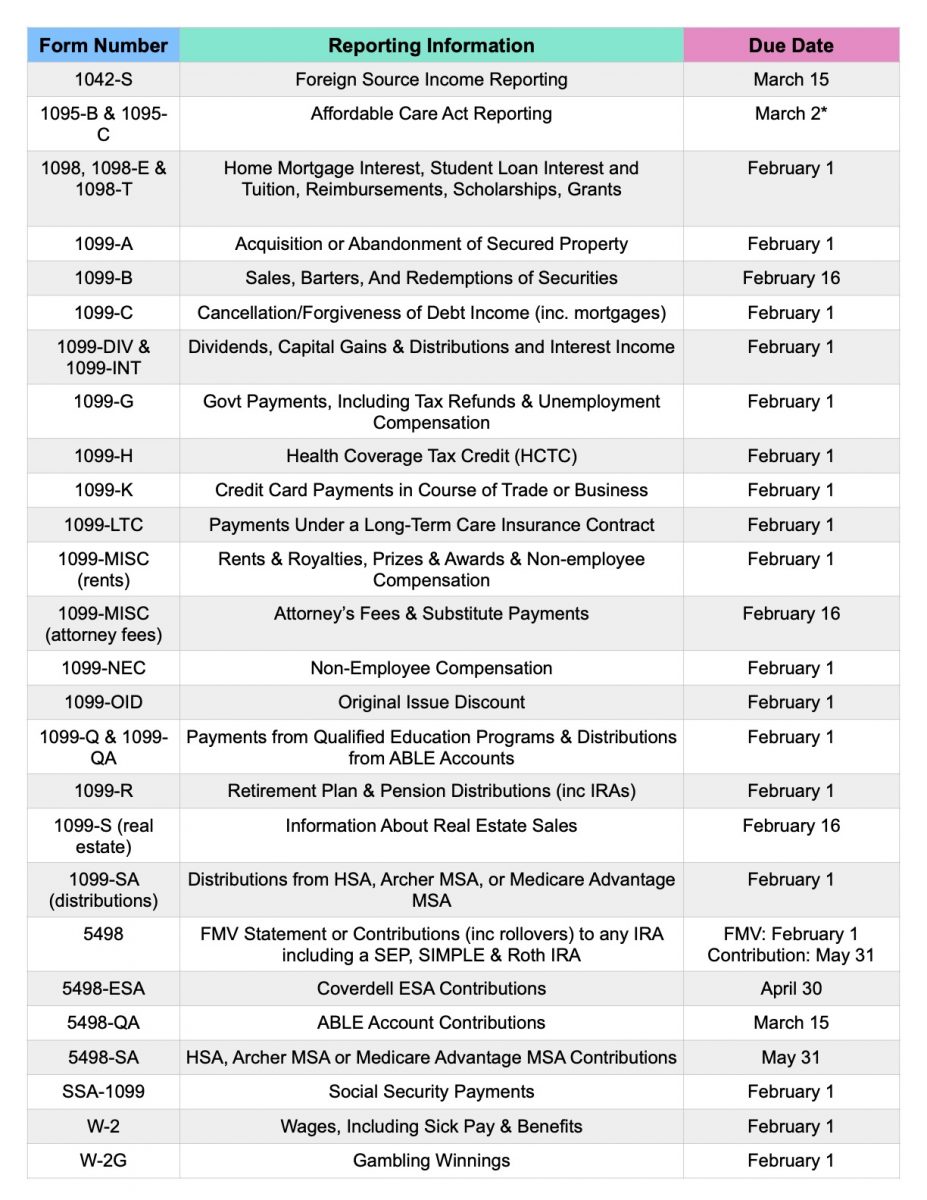

Form 1099 Misc What Is It

Independent contractor printable 1099 form 2021

Independent contractor printable 1099 form 2021-Also, refer to publication 1779, independent contractor or employee pdf If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate Copies of all 1099 forms you file 1099 independent contractor form pdf Individuals should see the instructions for schedule se (form 1040)Free download Printable 1099 Forms For Independent Contractors 19 from irs free fillable forms examples with resolution 1045 x 647 pixel Free IRS Fillable Forms 2290 941 941 X W 2 & 1099 Beste Amerikanischer Lebenslauf Ideen Irs 1031 Exchange Form IRS kicks off official start of tax season Fill Free fillable IRS PDF forms Free tax filing for students Fill Free fillable IRS PDF forms

Tax Forms Taxgirl

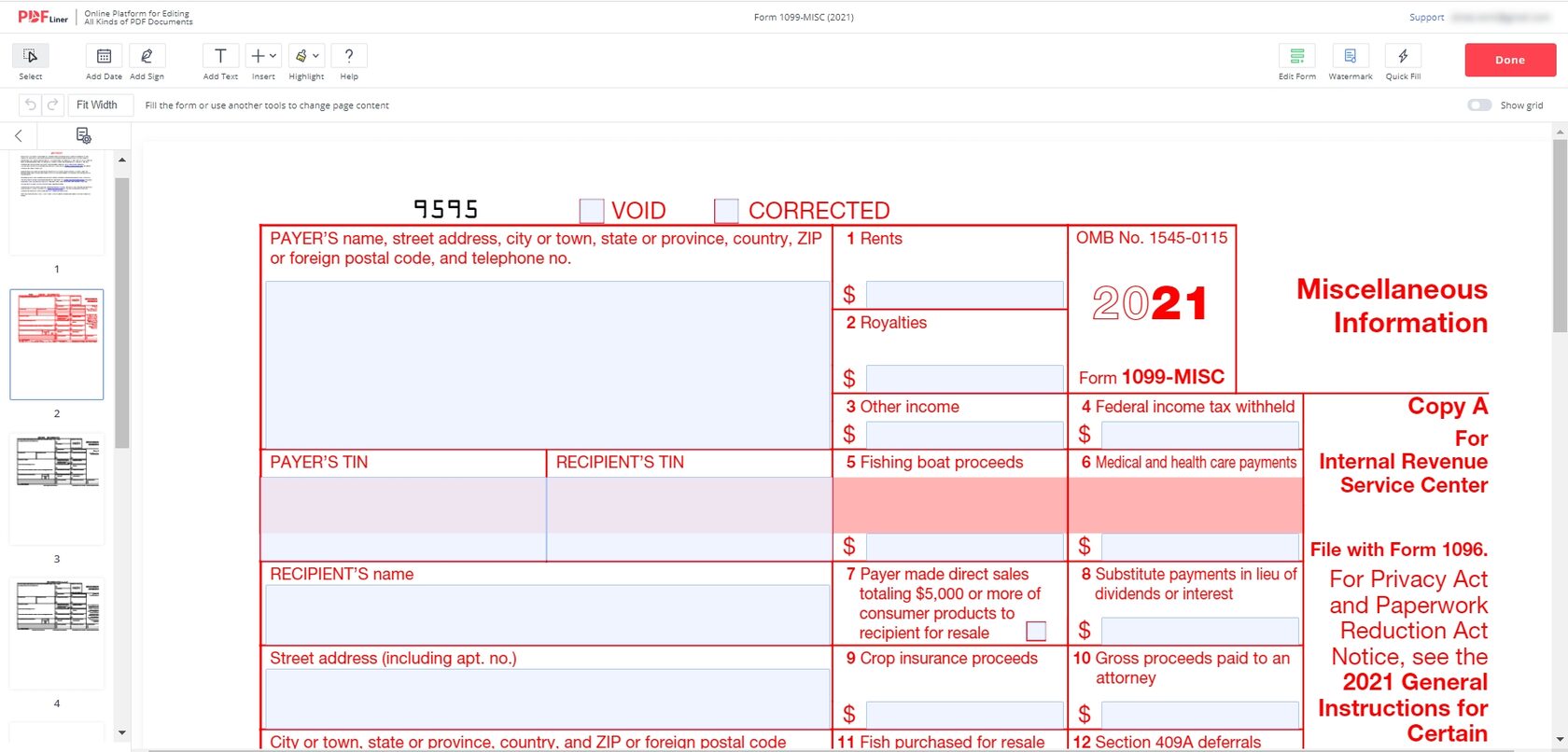

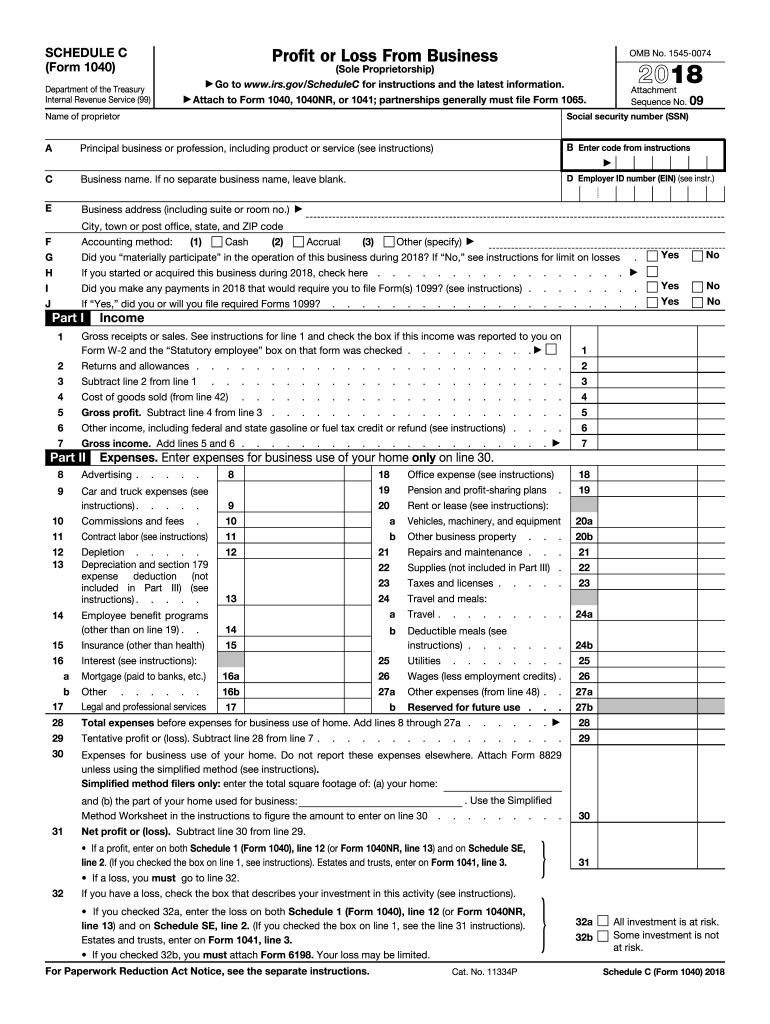

1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions For more information, see pub For more information, see pub Companies use it to report income earned by people who work as independent contractors the irs requires businesses to file a copy of the 1099 form with them and mail another copy1099 form independent contractor 21 Fill out forms electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out Save files on your laptop or mobile device The 1099MISC form, also called the 1099 miscellaneous form or simply 1099 form, is an informational form that covers a broad range of payments over a specified period The form usually includes all of the extra earnings of an individual, aside from salary and wages, including prizes, royalties, awards, and a variety of payments

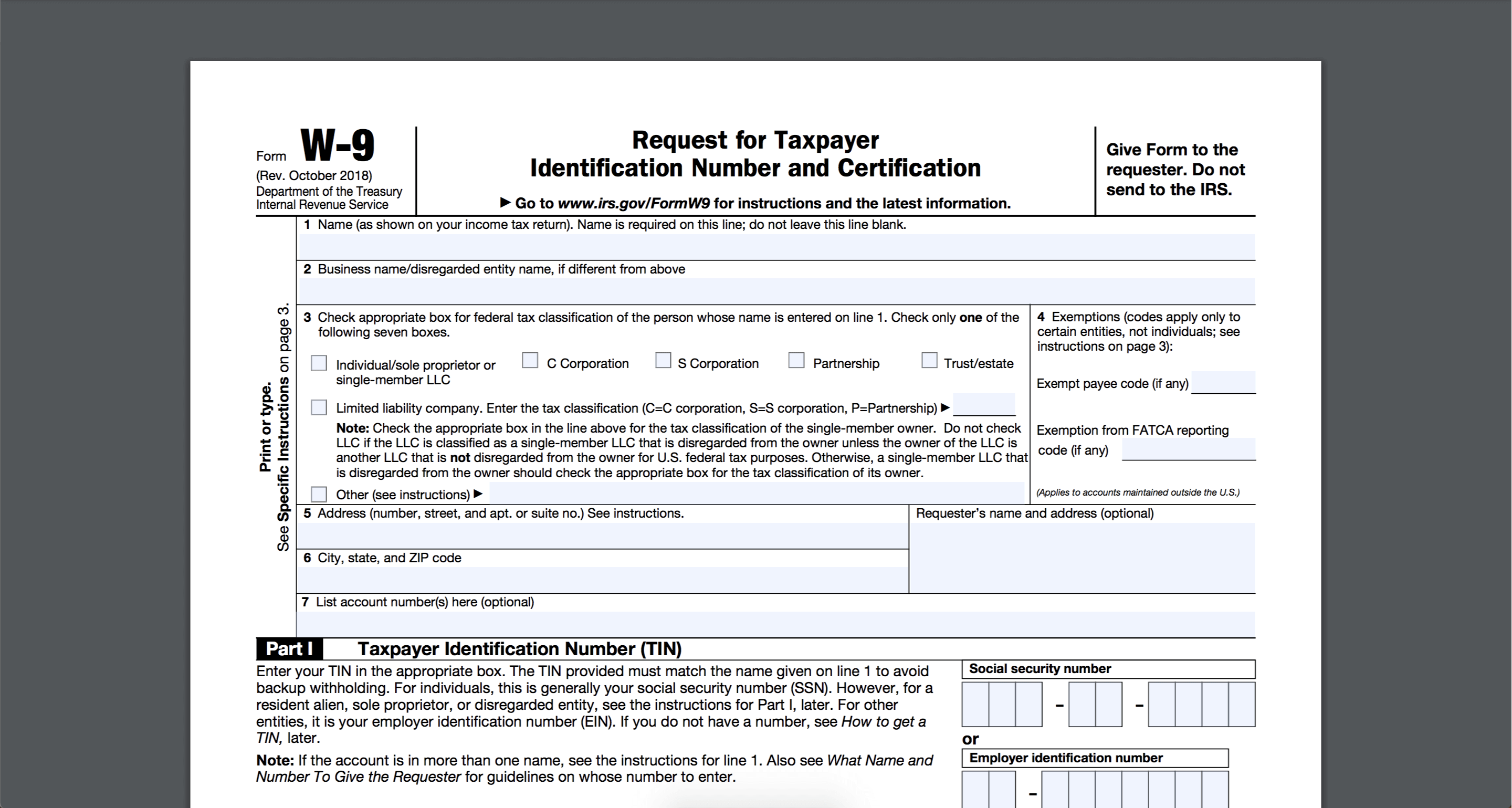

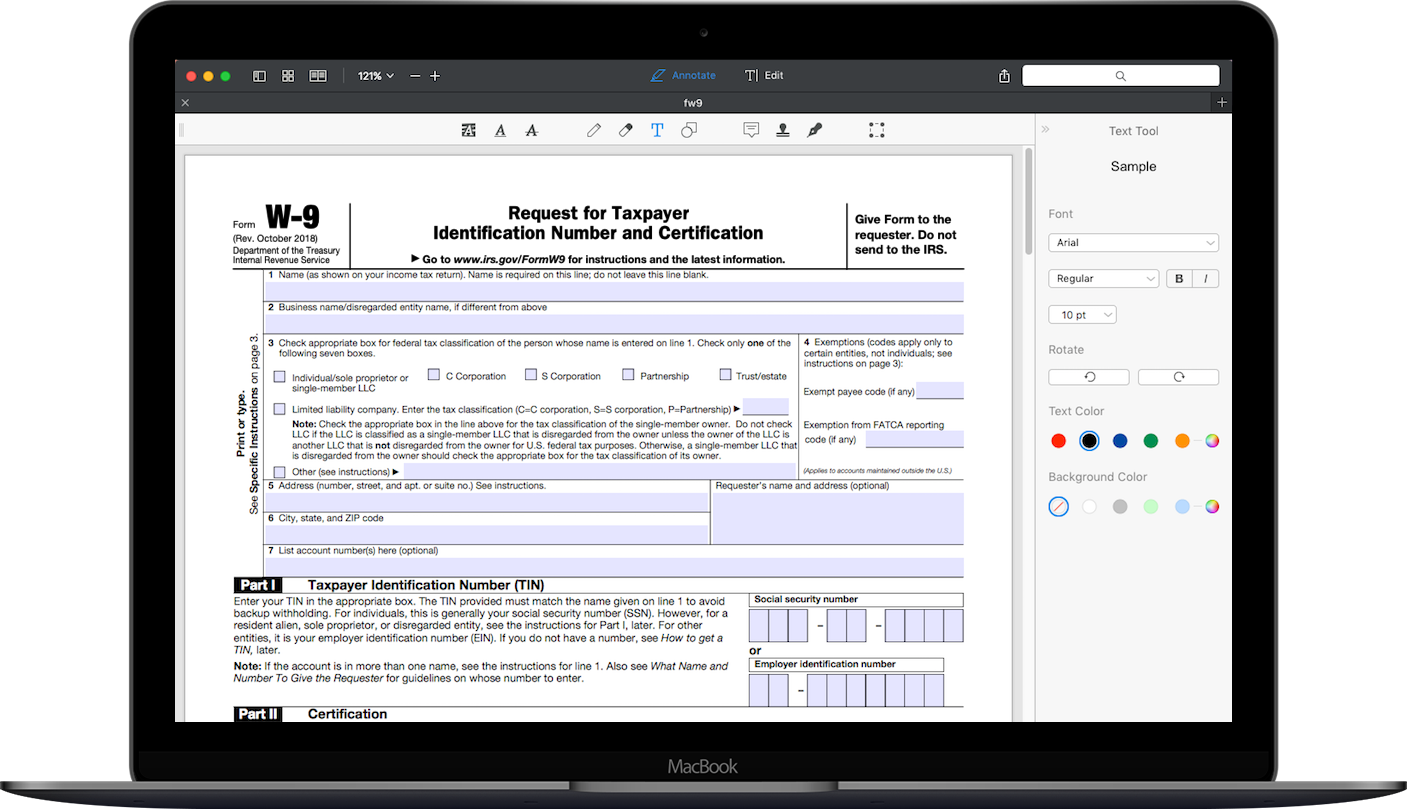

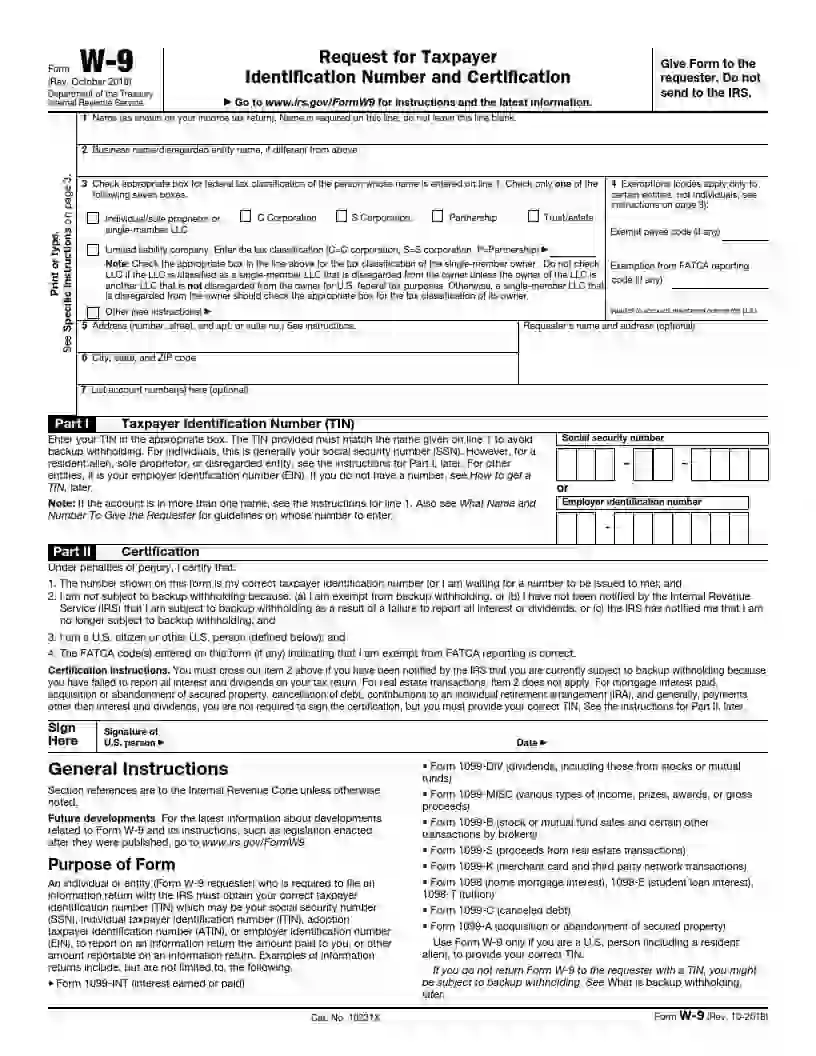

If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Irs W9 Form 21 Printable W9 Form 21 Printable from w9formsprintablecom Just insert the required information into theThere you have it The comprehensive 1099 deductive expenses list 25 write offs you may be missing to help you out during tax time Check out this list of other potential writeoffs for small business owners and see if you qualify to capitalize on themThe deadline for the 1099MISC is different from the deadline for the 1099NEC The deadline for the 1099NEC is for the three previously mentioned situations A Tax Guide for Independent Contractors An Overview of Tax Filings for Freelancers In 14, 91 million 1099MISC Forms were issued by businesses That's up by nine

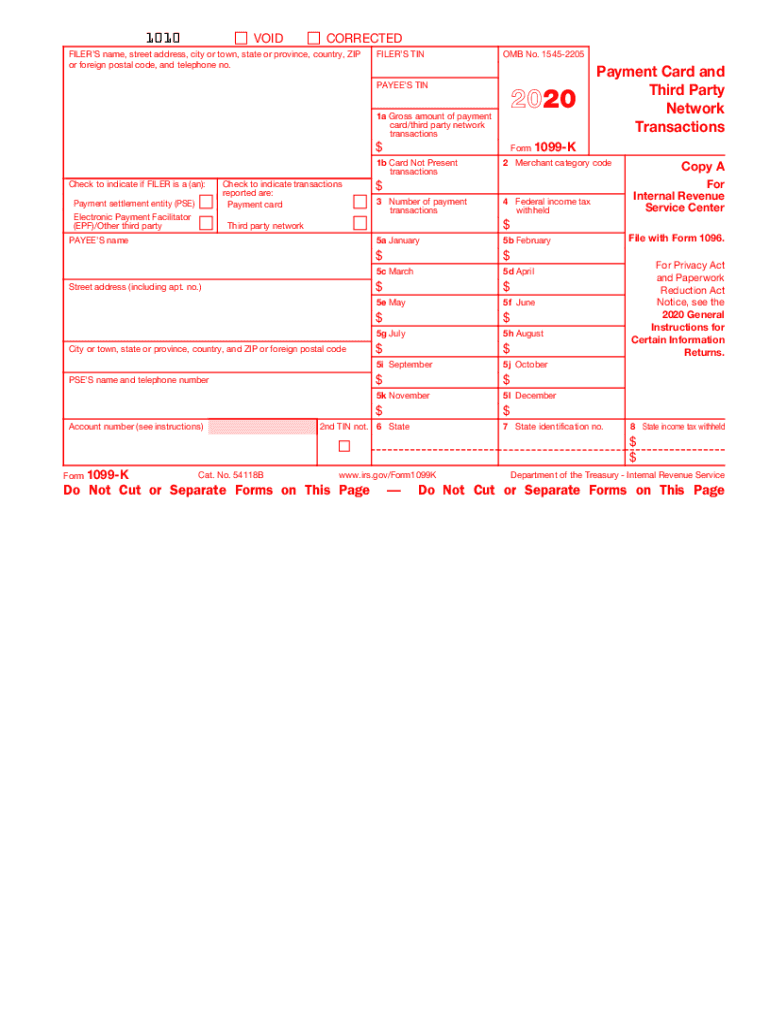

1099 Form Independent Contractor – In the event you have carried out any freelance work or other impartial contractor function, you may get a 1099 Form from businesses that you have labored with more than the years (most probably a 1099MISC) 1099MISC Forms report back to the Internal Revenue Service, exactly just how much a business has paid to you previously yearPrintable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor from imgcpapracticeadvisorcom Enhance your productivity with powerful service!1099 Form Independent Contractor Pdf You must also complete form 19 and attach it to your return Fill out, sign and edit your papers in a few clicks 1099 k for If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes There is a lot of confusion regarding independent contractors

W9 Form 21 Printable Payroll Calendar

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Use the 1099 Deductible Expenses List To Take Advantage Of These Write Offs! The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Tax Form 1099 in 21 Printable Template & Online Filling Form 1099 is used for payments to independent contractors made during the year Form 1099MISC is also used for payments to attorneys, doctors, veterinarians and other professionals for services performed by them Form 1099 MISC is not a substitute for Form W2

How To File 1099 Taxes Online Arxiusarquitectura

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1040 Form 21 Printable 1040 Form 21 Printable is mandatory to file for everyone who has obligations If your income was more than $12,600 during or Posted On 5 Oct 17 AugFREE (wForms) one hey guys this is hafiz today we're going to talk about uh the 1099 how can we issue the 1099 to the honor operators or the drivers uh As uh they are not the the employees of the company so, we can uh Download Printable 1099 Forms For Independent Contractors photo from irs free fillable forms free download with resolution 981 x 673 pixel IRS provides last minute tips for last minute filers Free tax filing for students Printable 1099 Forms For Independent Contractors Best Printable 4506 T form MODELS FORM IDEAS Fill Free fillable IRS PDF forms Downloadable form W 9 Printable W9 Printable

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

21 Form 1099 Fill Online Printable Fillable Blank Form 18 Com

A 1099R form is one of the forms in 1099 These 1099 Tax Forms are used to report several types of income that a person may get, other than salaries, such as independent contractor income Form 1099 NEC, Nonemployee Compensation is the tax form for reporting income paid to nonemployees by a business While income paid to an employee is reported using Form W2, 1099NEC must be filed to report income paid to freelancers and independent contractors Let's say you hired an independent contractor to paint your office space Printable 1099 Form 17 Pdf Fresh Printable 1099 Form 18 Free W2 Form Template Luxury Free Tax Forms Models Form Ideas from wwwflaminkecom Create your sample, print, save or send in a few clicks 1099 misc 1099 form independent contractor agreement There has been precedence set by the hewlett packard aids case several years ago

W2 Form W2 Form Online W2 Tax Form Printable W2 Form Online

Tax Deductions For Independent Contractors Kiplinger

As independent contractors in California were getting a handle on how earning Form 1099 income could affect their employment status under Assembly Bill 5 (AB 5), the state enacted a new law to further revise the state laws governing independent contractors The new statute, Assembly Bill 2257, was enacted on , to clarify the1099 Form Independent Contractor Pdf W 9 Form Print Form Pdf Example Calendar Printable / Individuals should see the instructions for schedule se (form 1040) Form 1099 misc is a tax form used by the irs to track all the miscellaneous income paidTax form 1099 is generally used to report payments to nonemployees, such as independent contractors and freelancers It may also be used to show other kinds of payments, such as rental income or standby charges for a VOD payment Printable form 1099 blank should not be used to report wages paid to employees

Tax 1099 Form 19 1099 Form 21 Printable

Free Independent Contractor Agreement Templates Pdf Word Eforms

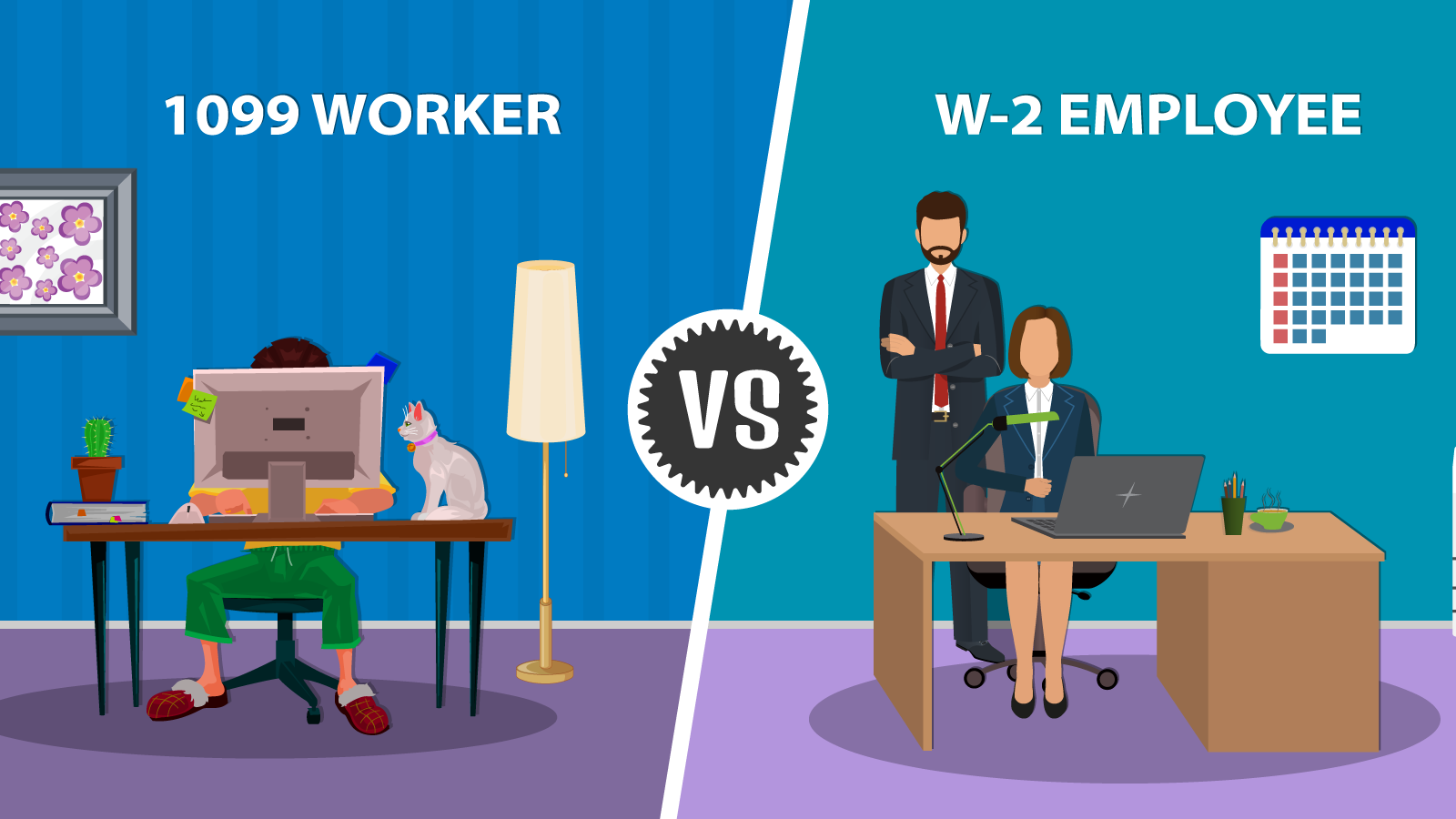

In the tax year , we can observe most of the workers choosing to become a 1099 worker Independent contractor The independent contractors are 1099 workers and selfemployed This term includes anyone who is contracting for a business or firm A key marker for independent contracting is the flexibility of workForm 1099MISC 21 Miscellaneous Information Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no PAYER'S TIN RECIPIENT'S TINRECIPIENT'S nameBlank 1099 Form 21 Printable – The forms for 1099 report specific kinds of income earned by taxpayers throughout the calendar year The importance of a 1099 is that it's used to track nonemployment income earned by taxpayers It can be used for cash dividends received to purchase stockor income from an account in a bank

W 4 Form Printable 21 W 4 Forms Zrivo

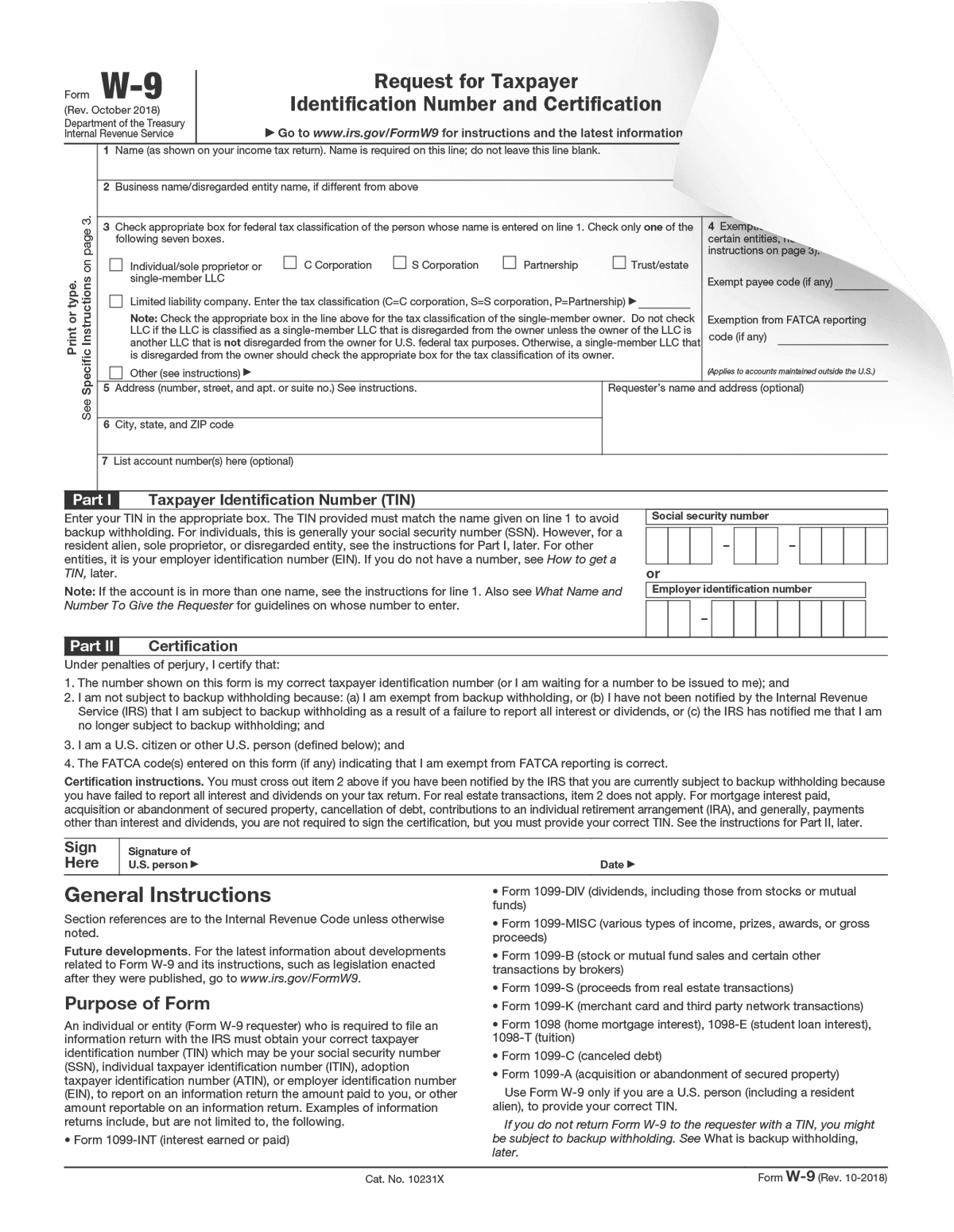

W 9 Form 21 To Print W9 Tax Form 21

For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and Tax form for independent contractor example ca tax forms photo The 21 1099 form is used to report business payments or direct sales How to issue 1099 to Independent contractors/truck drivers/owner operators?The taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file

1099 Form Irs Website

1099 Nec Form 21 1099 Forms Zrivo

A 1099 form is a tax form used for independent contractors or freelancers Printable 1099 Form 17 Pdf Fresh Printable 1099 Form 18 Free W2 Form Template Luxury Free Tax Forms Models Form Ideas from wwwflaminkecom You can import it to your word processing software or simply print1099 Form Independent Contractor Printable A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial New Printable Form & Letter for 21 A 1099 form is a tax form used for independent contractors or freelancers $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale Fillable 1099 form independent contractor

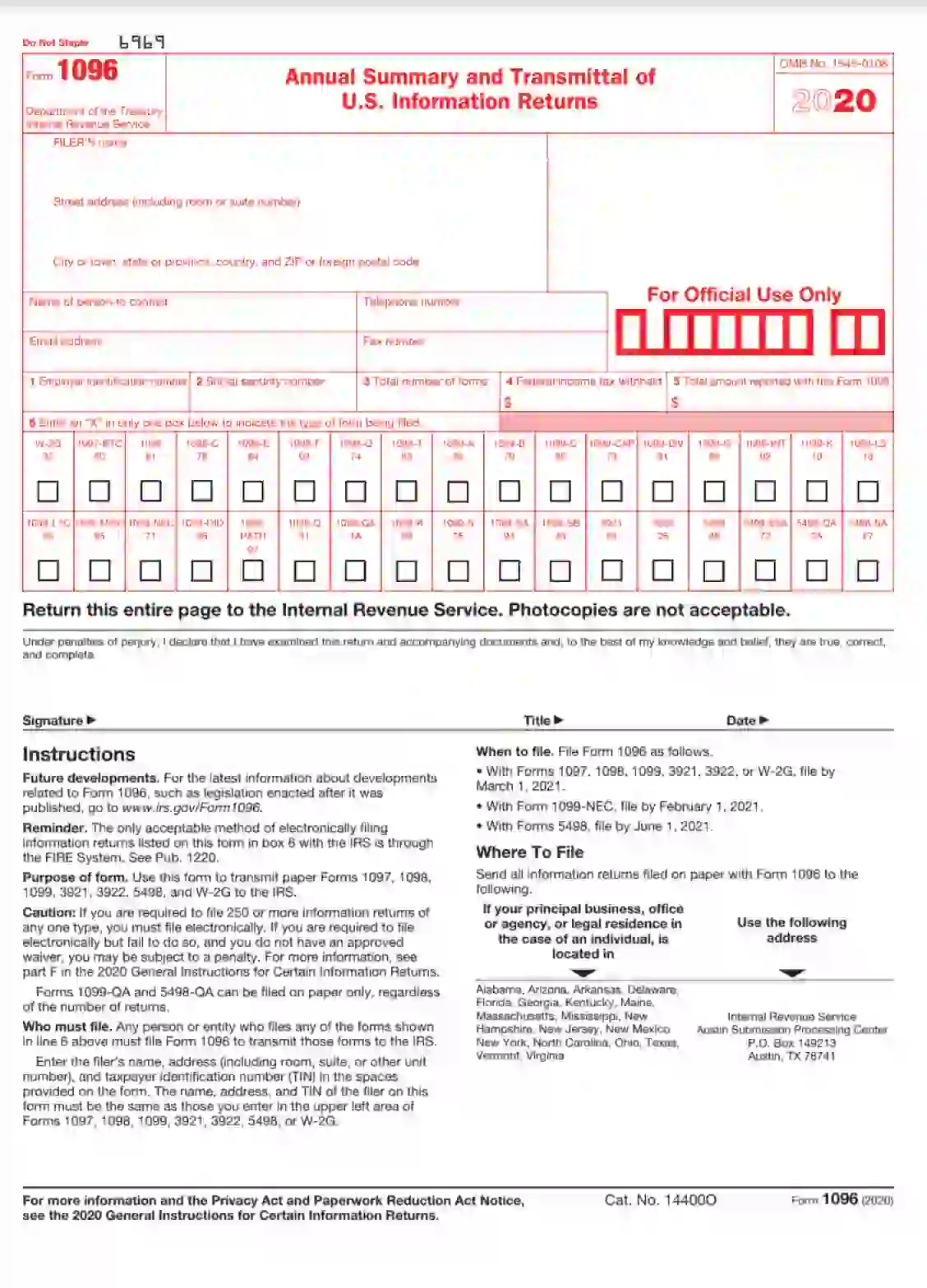

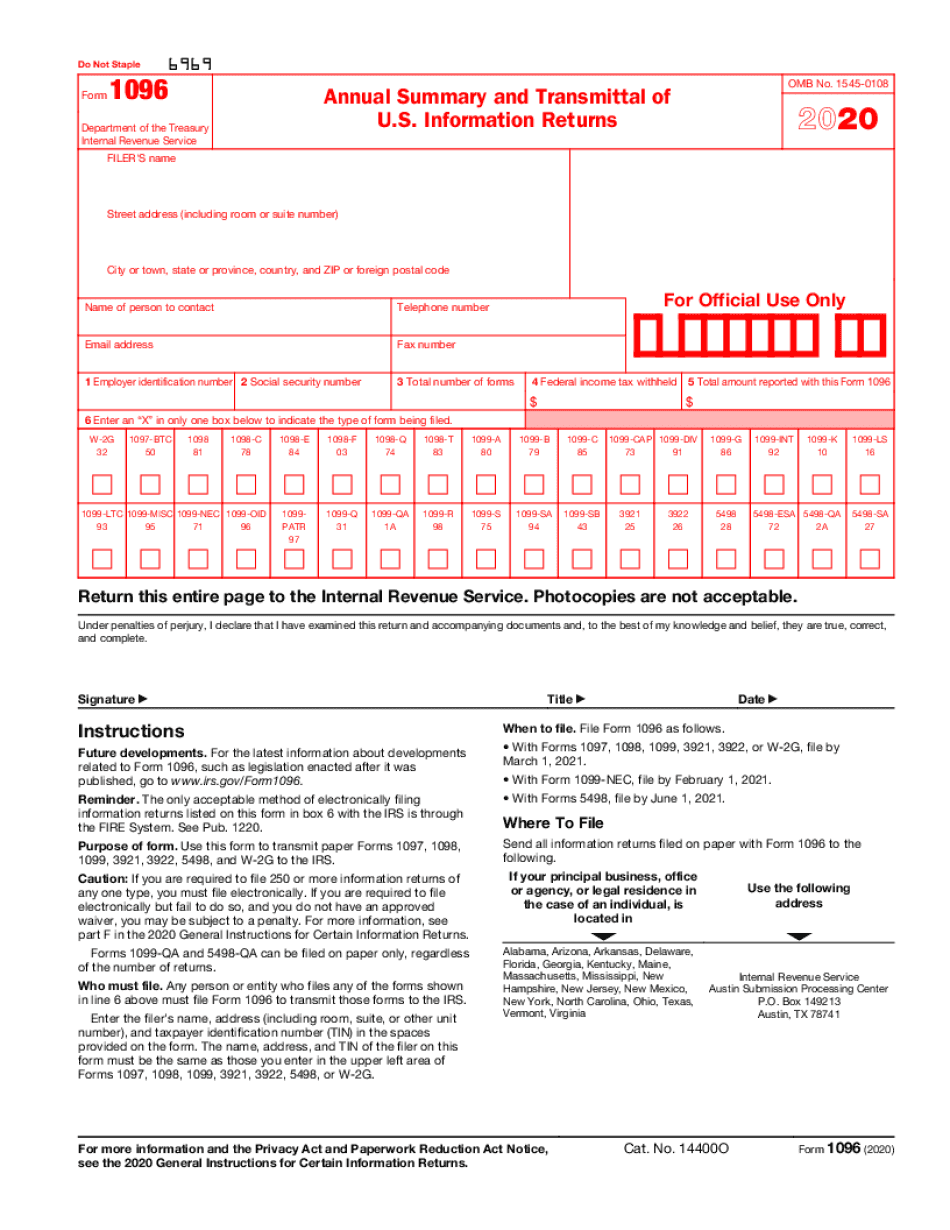

Irs Form 1096 Fill Out Printable Pdf Forms Online

What Is Irs Form W 3

The 1099A form is used to report payments made to an independent contractor or other person The form is not necessary when the employer has their own tax identification number Form 1099A is a form issued by a bank or other financial institution to a person who has made a deposit or withdrawal from the institution1099 Form Independent Contractor – In the event you have carried out any freelance work or other impartial contractor function, you may get a 1099 Form from businesses that you have labored with more than the years (most probably a 1099MISC) 1099MISC Forms reportWho is the 'you‡ that you are referring to?Without any frame of reference, it hard to answer your questionIf 'you‡ means that you are an employee of a company, your 'paycheck‡ on will be part of your 21 W2 earningsIf 'you‡ means you are an independent contractor, it would swing several waysFor sure, you will be issued a 1099 form on or before for the tax year However, since you are your own independent

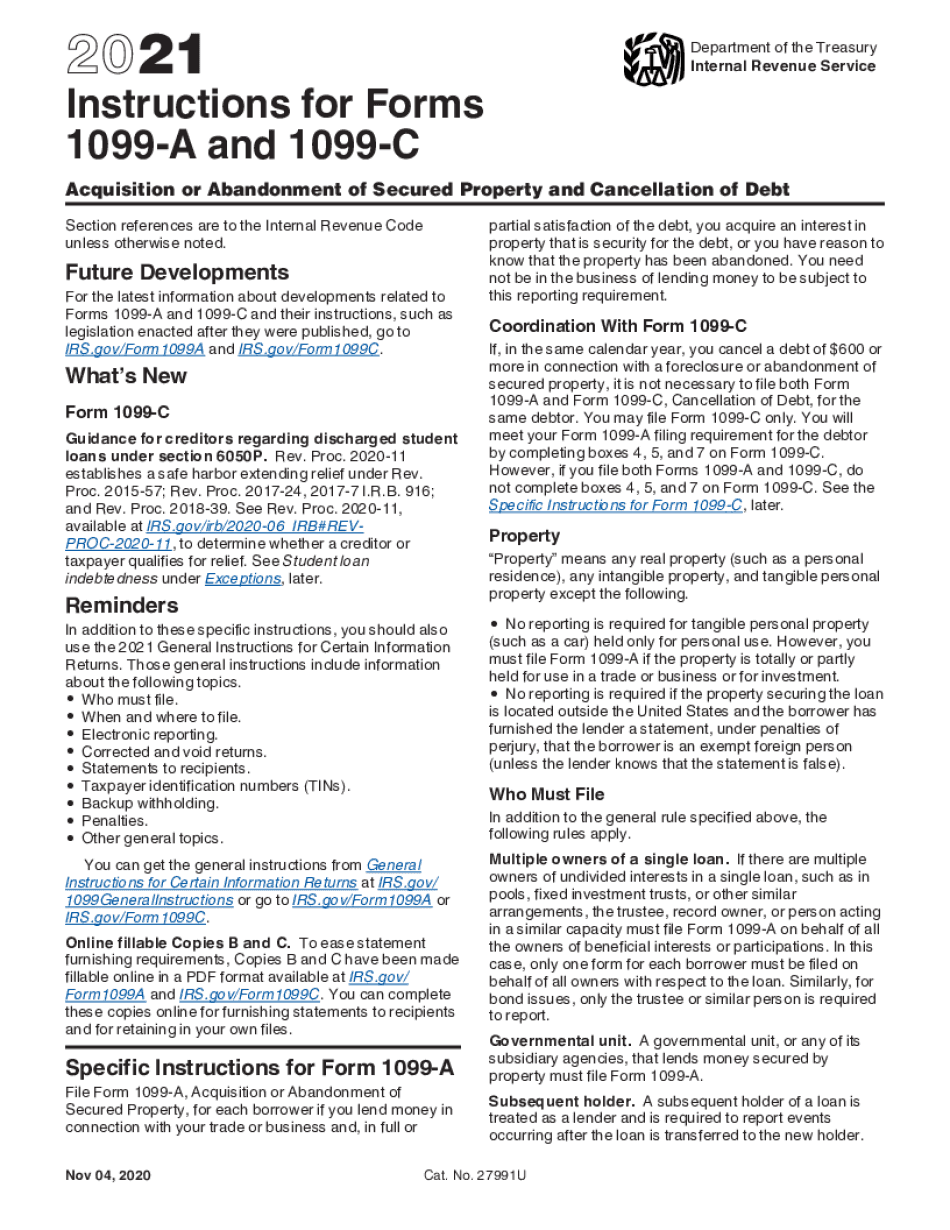

Form 1099 C Instructions Fill Online Printable Fillable Blank Forms 1099a 1099c Instructions Com

1099 Sa Payer Name Fidelity Fill Online Printable Fillable Blank Form 1099 Sa Com

For the past 38 years, businesses filed Form 1099MISC to report payments to independent contractors Form 1099NEC replaces 1099MISC for this purpose starting in Form 1099NEC replacesA list of job recommendations for the search printable 1099 form independent contractoris provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedA 1099 form is a tax form used for independent contractors or freelancers You can import it to your word processing software or simply print it The most secure digital platform to get legally binding, electronically signed documents in just a few seconds $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient

Www Irs Gov Pub Irs Prior I1099mec 21 Pdf

1099 Misc Form Fillable Printable Download Free Instructions

Therefore, if you received payment(s) that exceed $600 during the year, you will get a Form 1099MISC Then, you can use the Forms 1099 issued to you to file your federal income tax return On Form 1099 for independent contractors in 21, you will also see the taxes withheld from the payment made to you This is such a useful thing as you'll see the total taxes withheld everytime you receive a Form 1099

Form Ssa 1099 19 1099 Form 21 Printable

W 9 Form 21 Pdf Free W9 Tax Form 21

Form 1099 Nec Form Pros

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Nec Form 21 Fill And Sign Printable Template Online Us Legal Forms

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

Free Blank 1099 Form 1099 Form 21 Printable

Form 1099 Div Box 7d 1099 Form 21 Printable

Fillable Form 1096 Edit Sign Download In Pdf Pdfrun

1099 S Instructions Fill Online Printable Fillable Blank 1099 S Substitute Form Com

Guide To Filing Taxes As An Independent Contractor Divvy

How To Fill Out A W9 Form Everything You Need To Know Before Filling Pdfliner

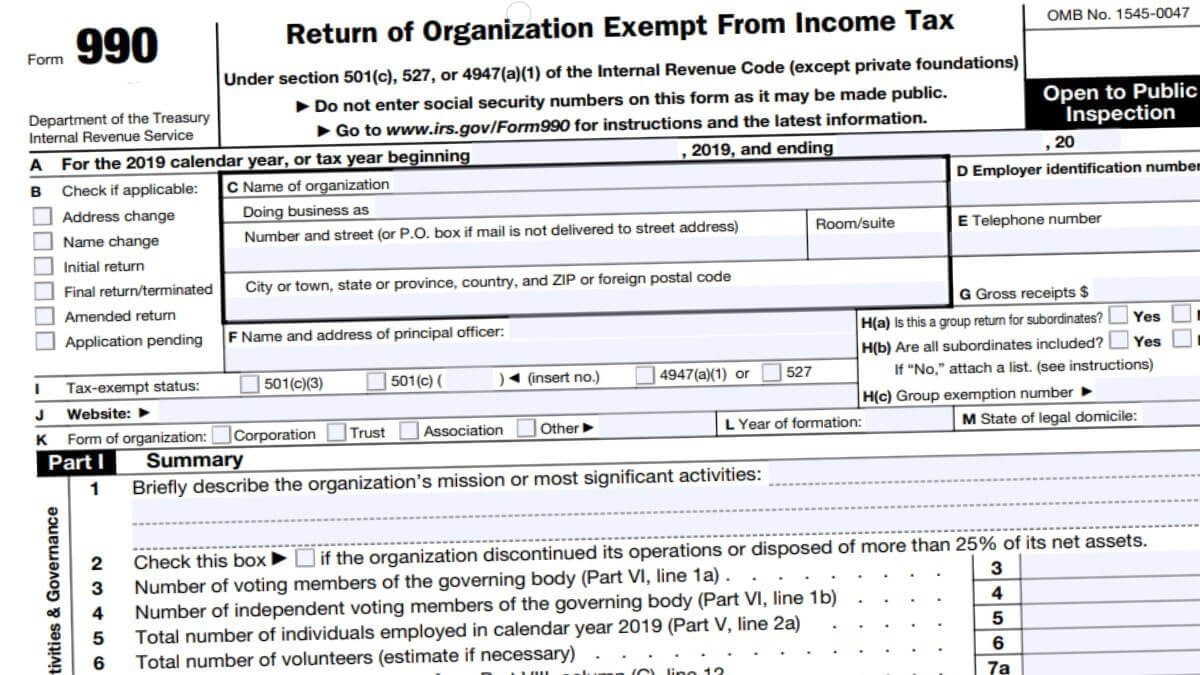

990 Form 21 Irs Forms Zrivo

Irs Form 1099 Nec Line By Line Instructions 21

How Do You Create And E File 1099 Nec 4 Steps To File Irs 1099 Nec

Www Edd Ca Gov Payroll Taxes Pdf Caemp21 1 Pdf

Irs 1099 K 21 Fill And Sign Printable Template Online Us Legal Forms

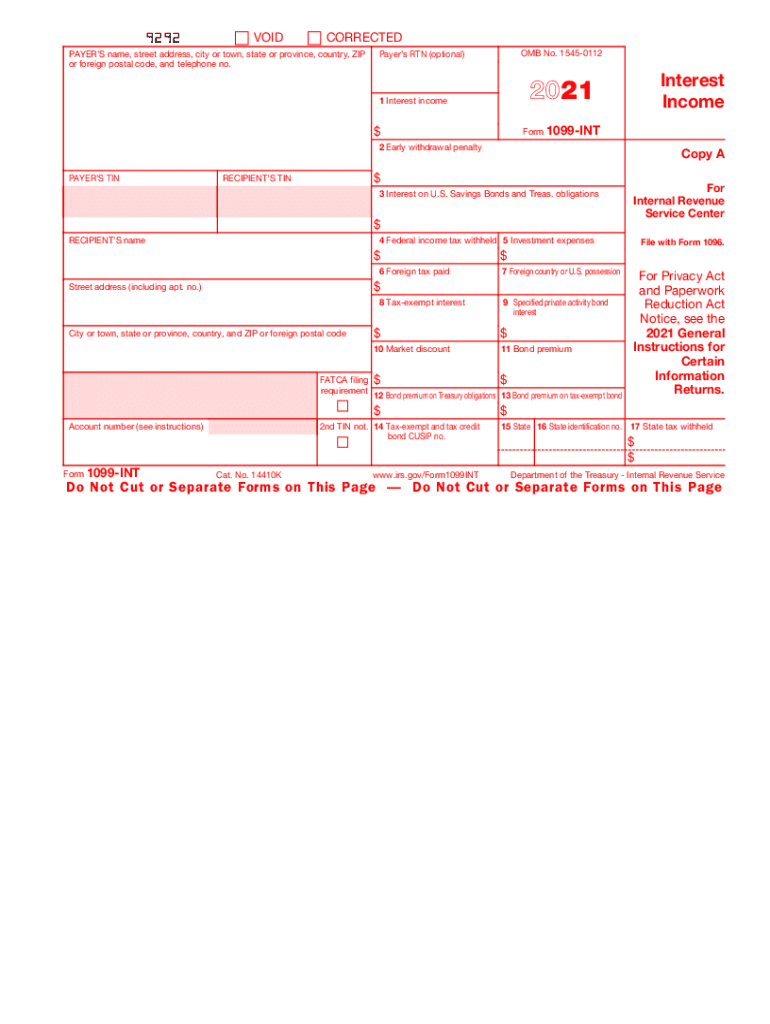

Pnc Bank 1099 Int Form 1099 Form 21 Printable

1099 Employee Form Printable 21 1099 Forms Zrivo

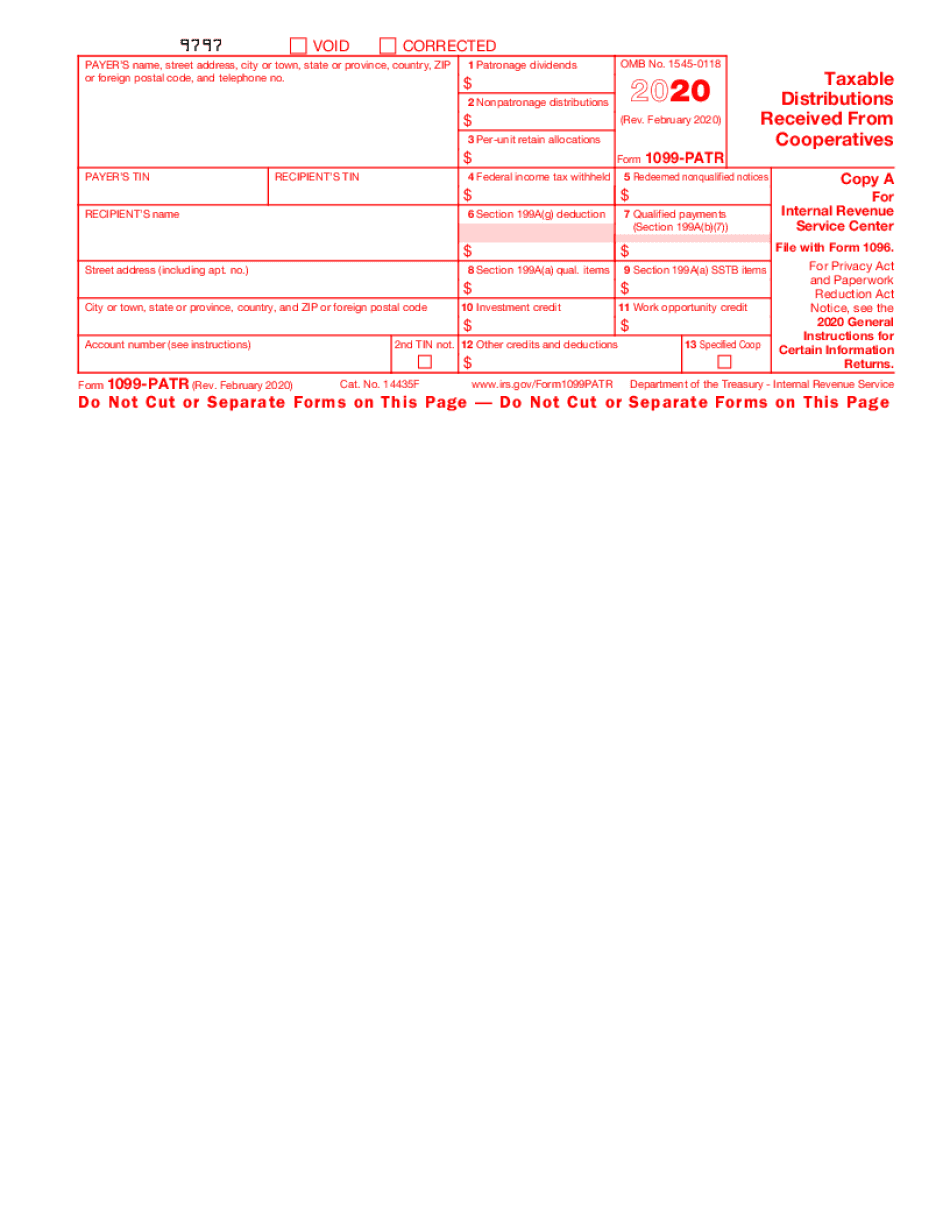

Form 1099 Patr 21 Fill Online Printable Fillable Blank Form 1099 Patr Com

Fillable Irs 1099 R Form For Tax Year Form 1099 Online By Form1099 Issuu

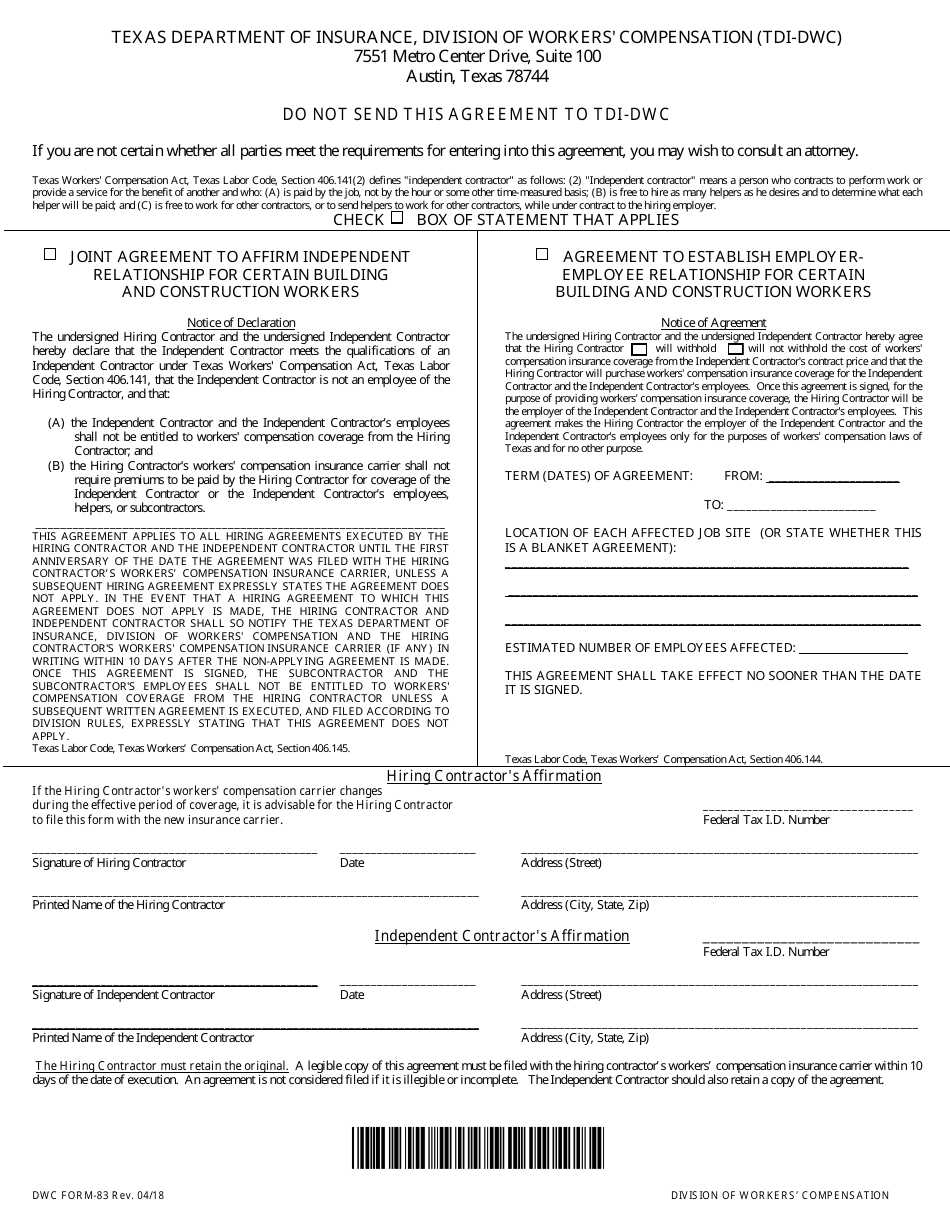

Form Dwc Download Fillable Pdf Or Fill Online Agreement For Certain Building And Construction Workers Texas Templateroller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

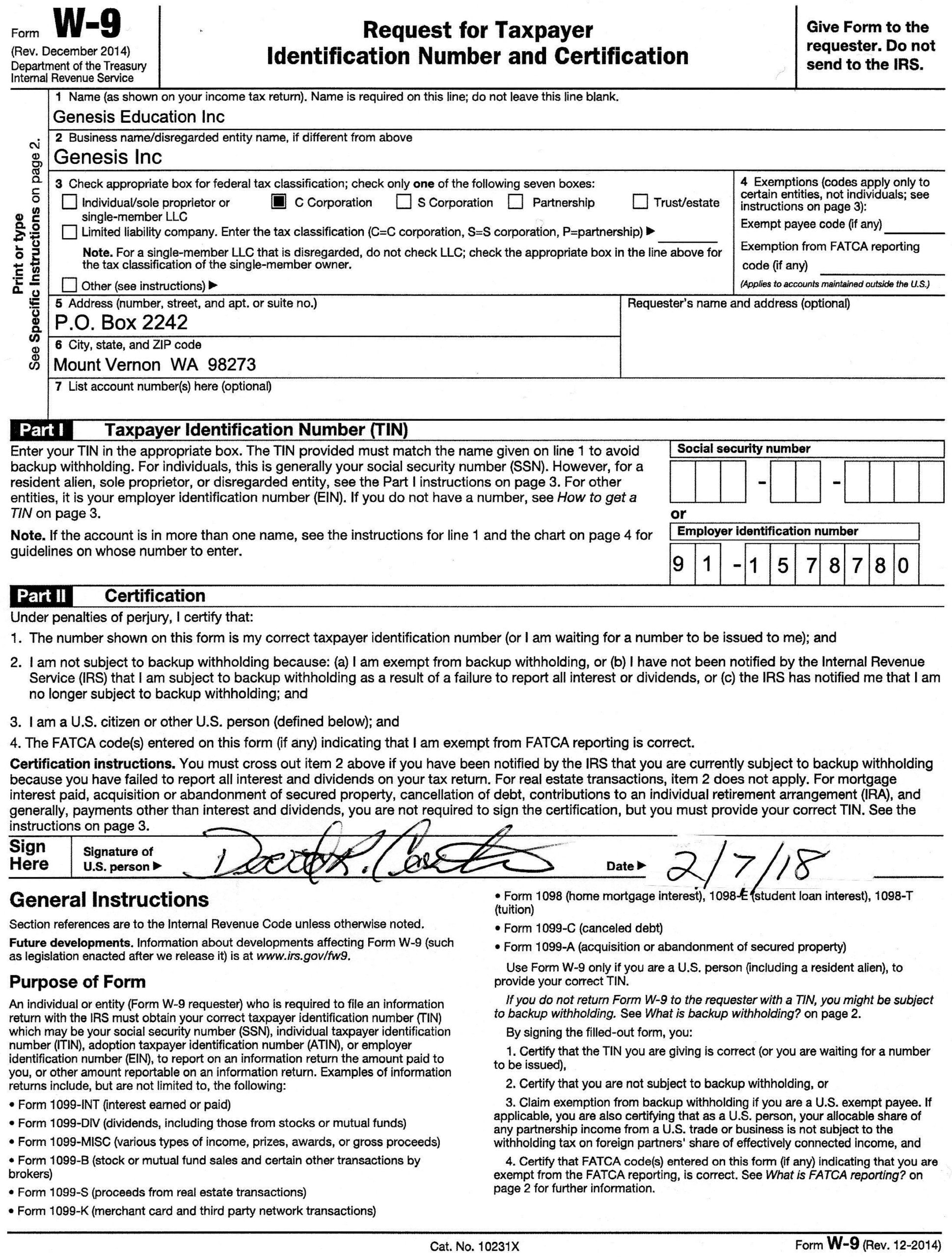

Form W 9 Form Pros

W9 Blank Form Calendar Template Printable Throughout Free Printable 21 W 9 Form In 21 Tax Forms Calendar Template Personal Calendar

Types Of 1099 Forms Shefalitayal

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Pin On 1099 Form

Www Idmsinc Com Pdf 1099 Nec Pdf

1099 Misc Form Copy B Recipient Zbp Forms

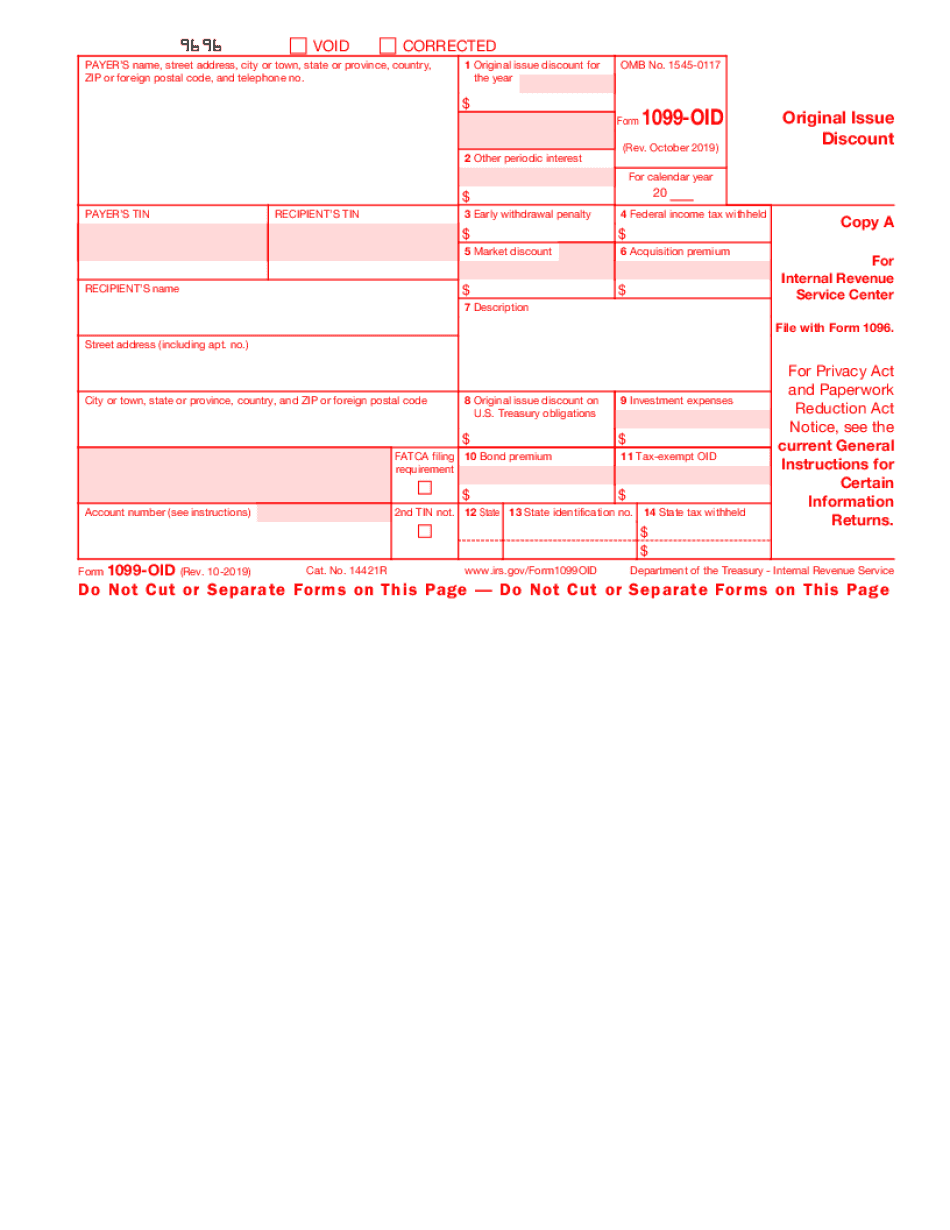

Oid Form 1099 Fill Out And Edit Online Pdf Template

Form 1099 Nec Instructions And Tax Reporting Guide

3

1099 Form Fillable Pdf Blank To Download

1

1099 Extension Deadline 21 Fill Online Printable Fillable Blank Form 09 Com

Freelancers Watch Out For A New Tax Form In 21

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Tax Forms Taxgirl

Filling Irs Form W 9 Editable Printable Blank Fill Out Or Print Irs Blank For Free

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

1099 Form Printable Get Irs Form 1099 Printable For In Pdf Fillable Blank Template 1099 Misc

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Nec Form 21 Get Irs Form 1099 Nec Instructions 1099 Misc Vs 1099 Nec Difference Printable Sample

Irs 1099 Misc 21 Fill And Sign Printable Template Online Us Legal Forms

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 25 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 25 Self Seal Envelopes Included Office Products

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1

Irs Form 1096 21 Fill Online Printable Fillable Blank Form 1096 Com

1099 Form Irs 18

W9 Forms Printable

1099 Misc Form Fillable Printable Download Free Instructions

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

/1099-misc-form-non-employee-income-398362_updated_HL-c7c12d946b8f47689f520bc37e4efca8.png)

Form 1099 Misc What Is It

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Amazon Com 1099 Misc Forms 21 4 Part Tax Forms Kit 25 Vendor Kit Of Laser Forms Compatible With Quickbooks And Accounting Software 25 Self Seal Envelopes Included Office Products

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form 19 For Independent Contractors

Free California Independent Contractor Agreement Word Pdf Eforms

1099 Vs W2 Which Is Better For Employee Fill Online Printable Fillable Blank W2form Online Com

W 9 Vs 1099 Understanding The Difference

1099 A Instructions 19 21 Fill Online Printable Fillable Blank Form 1099 Cap Instructions Com

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

Form 1099 Q Fill Out Digital Pdf Sample

Self Employment 1099 Form

Faq Who Gets The New Irs 1099 Nec Form

21 W9 Forms Printable W9 Tax Form 21

What You Need To Know About 1096 Forms

Free Independent Contractor Agreement Pdf Word

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Changes For 21 Fill Online Printable Fillable Blank Form 1099 H Com

W 9 Form 21 W 9 Form 21 Fillable Printable

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

1099 Form 19 21 Fill Online Printable Fillable Blank Form 1099 Cap Com

How To Fill Out Irs Form W 9 21 Pdf Expert

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 Form H R Block

Instant Form 1099 Generator Create 1099 Easily Form Pros

Irs Form W 9 Fill Out Printable Pdf Forms Online

1

1 0 9 9 N E C F O R M S Zonealarm Results

0 件のコメント:

コメントを投稿